There is an interesting fight going on in Germany: Battery proponents and hydrogen fuel cell fans are at each other’s throats. What else is new, you say? What’s new are the unusual brawlers: In the BEV corner, weighing in at 10+ million units a year, is Germany’s Volkswagen. Tag-teaming in the FCV corner are the world’s largest, and 4th-largest automotive component suppliers, Bosch and Continental.

Listening in on the fight, one might think it is the usual exchange of heavy trolling we love to follow on Twitter, or Reddit. Except that now CEOs of legacy dinsosaurs are hating on each other.

“Compared to the BEV, there is no alterative if we want to comply with the environmental rules handed down by the governments,” Volkswagen Group CEO Herbert Diess told Germany’s Frankfurter Allgemeine Zeitung in an interview last week [German, paywall.] A BEV would produce only half the CO2 of an ICE, even if some of the electricity “is still produced in coal-fired powerplants.” With more green energy in the mix, the BEV would look even better, Diess said. He even allowed a little flirt with nuclear energy, power that is gaining favor with BEV fans in America, but that is politically ultra-incorrect in Germany, where the last remaining nuclear plants will be euthanized only three years from now.

Listening to Volkswagen, one gets the impression that the ICE is already dead. Diess’s comments echoed a study published by Volkswagen a week earlier, saying that due to energy generation and supply, a BEV would account for 62 g CO2/km when driven, while a corresponding diesel would blow double the amount into the atmosphere.

Measured over the whole lifecycle, the BEV results aren’t quite as rosy. “In contrast, most emissions from the battery-powered electric vehicle are generated in the production phase,” said the quoted study, but even when taking “battery production and the complex extraction of raw materials” into account, “the current Golf TDI (Diesel) emits 140g CO2/km on average over its entire life cycle, while the e-Golf reaches 119g CO2/km,” Volkswagen said. The study was so impressive that the hardcore pro-Tesla outlet Teslarati enthused that “Tesla rival Volkswagen takes stand against FUD on electric cars’ carbon footprint.”

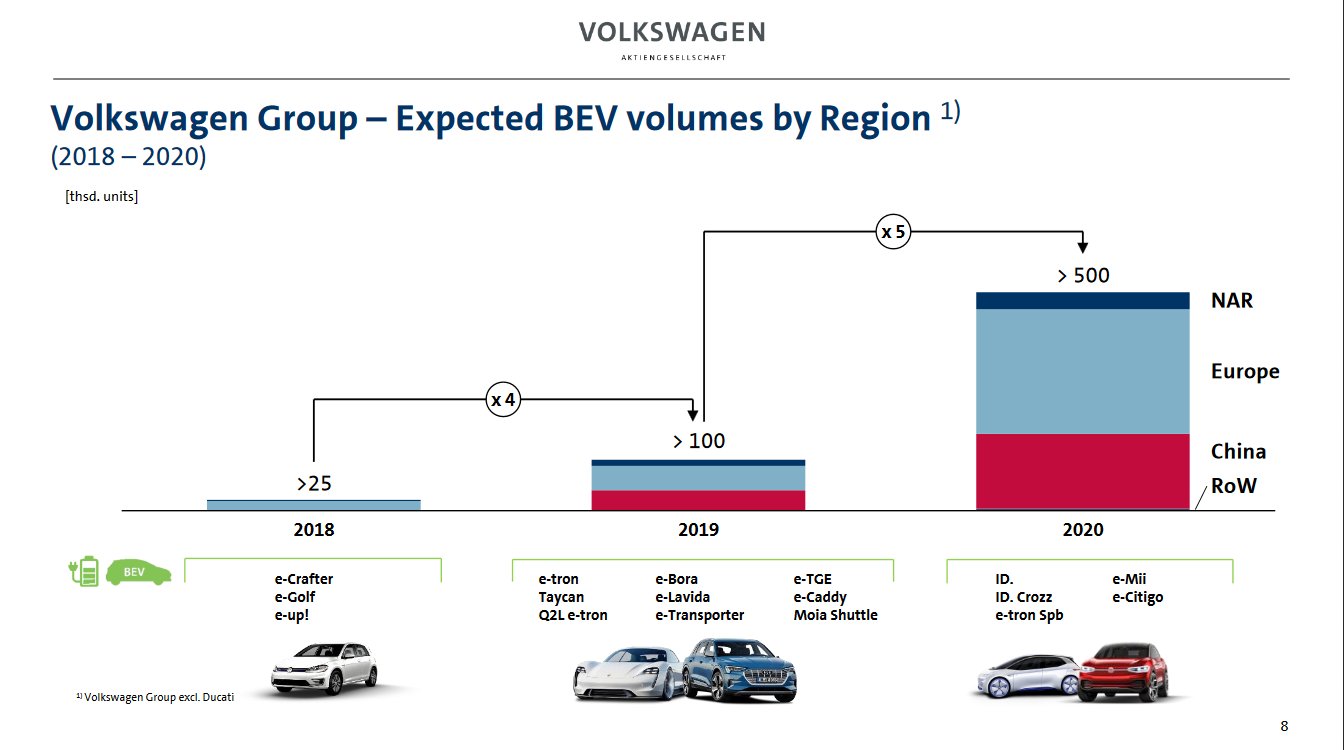

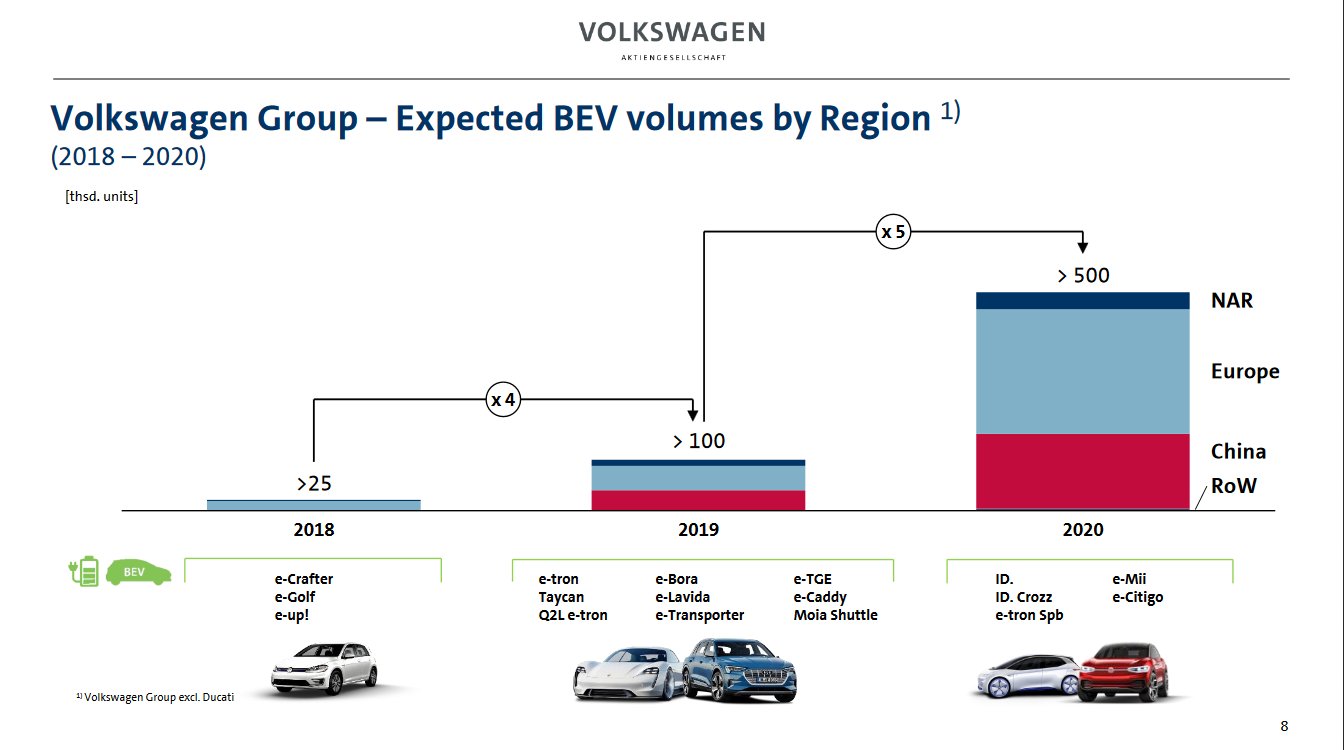

Volkswagen sounded even more like a Tesla reincarnate when Volkswagen released its quarterly results, along with the flabbergasting prediction that it plans to make and sell 500,000 battery-electric vehicles not in the next decade, but next year. Yes, you have read that right. After making 25,000 BEVs last year, Volkswagen wants to end 2019 with more than 100,000 BEVs produced, and it wants to increase that number five-fold in 2020 to 500,000 – most likely without ever mentioning “exponential growth,” because those half a million BEVs are just 5% of Volkswagen’s overall annual output. Powered by 17 (!) BEV models across all members of the Volkswagen Group, Volkswagen wants to reach that goal; by selling most of the BEVs in Europe and China. Other than often pie-in-the-sky announcements of Tesla CEO Elon Musk, Volkswagen’s forward-looking statements at financial results conferences are usually taken seriously.

Much less enamored with Volkswagen’s “BEV über alles” stance than Teslarati were the heads of global supplier powerhouses Bosch and Continental. At Continentals recent shareholder conference, CEO Elmar Degenhardt said that placing all bets on BEVs is “very risky,” and he pleaded to remain open for other technologies, for instance fuel cells. Bosch announced a cooperation with Swedish fuel-cell company Powercell, and while saying no to producing battery cells, Bosch aims to become a leading supplier of fuel cell stacks. At the end of the next decade, “20 percent of all EVs will be powered by fuel cells,” Bosch’s Managing Director Stefan Hartung predicted.

Volkswagen’s battery-bet also seems to ignore a sudden policy shift in China. Volkswagen’s largest single country market has started a pivot from lower-tech batteries to high-tech fuel-cells. China is cutting back formerly very generous subsidies for BEVs, and it shifts them to fuel cells.

Opposition to Diess’s BEV strategy is growing even in Volkswagen’s own ranks. Germany’s Handelsblatt reported last week that Audi is gearing up to become Volkswagen’s fuel cell expert. A hydrogen-powered car is said to be planned for release in 2021.