Chinese automotive battery supplier Contemporary Amperex Technology Limited (CATL) is no stranger to rapid growth. In just over 10 years, CATL has become one of the most successful electric vehicle component manufacturers in the world, cornering nearly a third of the EV battery market in 2021.

In a presentation at the 2022 World New Energy Vehicle Congress, CATL Chairman Zeng Yuqun shared that the supplier has worked up a new high-density cell for EVs. The proprietary chemistry, according to Yuqun, is capable of boosting EV range by 20% versus modern iron-phosphate batteries.

CATL calls its new battery M3P, and despite being a supplier of batteries for Tesla, that name doesn’t mean “Model 3 Performance.” Instead, M3P is the branding of the amalgam of minerals that make up the cells. Yuqun says that the chemistry of CATL’s new M3P cells means an expected improvement in energy density of around 15 percent over CATL’s current lithium iron phosphate (LFP) battery packs which have an energy density of around 210 watt-hours per kilogram.

This density increase could translate into a 10% increase in real-world range. Yuqun noted that the M3P cells are targeted toward automakers looking to offer more than 430 miles (700 kilometers) of range on a single charge.

The stated figures back up rumors sparked earlier this year that Tesla would offer CATL’s new M3P cells in cars built at Gigafactory Shanghai. Current made-in-China Model 3s offer a range of around 420 miles (675 km) when measured in accordance with the China Light-Duty Vehicle Test Cycle (CLTC). For comparison, the U.S.-built Model 3 Long Range offers around 358 miles on a single charge, as measured by the EPA. A 10% bump in range would put Tesla’s cars at over 700km of range, or within the target range mentioned by Yuqun.

Even if the rumors of a pack upgrade a true, it’s still quite unlikely that U.S.-market Teslas will see the same improvement.

CATL reportedly struck a deal with Dynanonic, a Shenzhen-based lithium supplier, to acquire some of the minerals necessary to manufacture its M3P cells. In order for a vehicle to qualify for the revamped U.S. EV tax credit, it cannot include minerals sourced from countries of particular concern—including China—from 2025 and beyond. That means that if Tesla equipped its vehicles with a CATL pack that sourced or processed lithium in China, it may immediately become ineligible for the credit. CATL was considering a North American expansion with a potential $5 billion battery plant in Mexico, however, it reportedly told Chinese authorities last month that it would delay its North American expansion amid growing U.S. tensions.

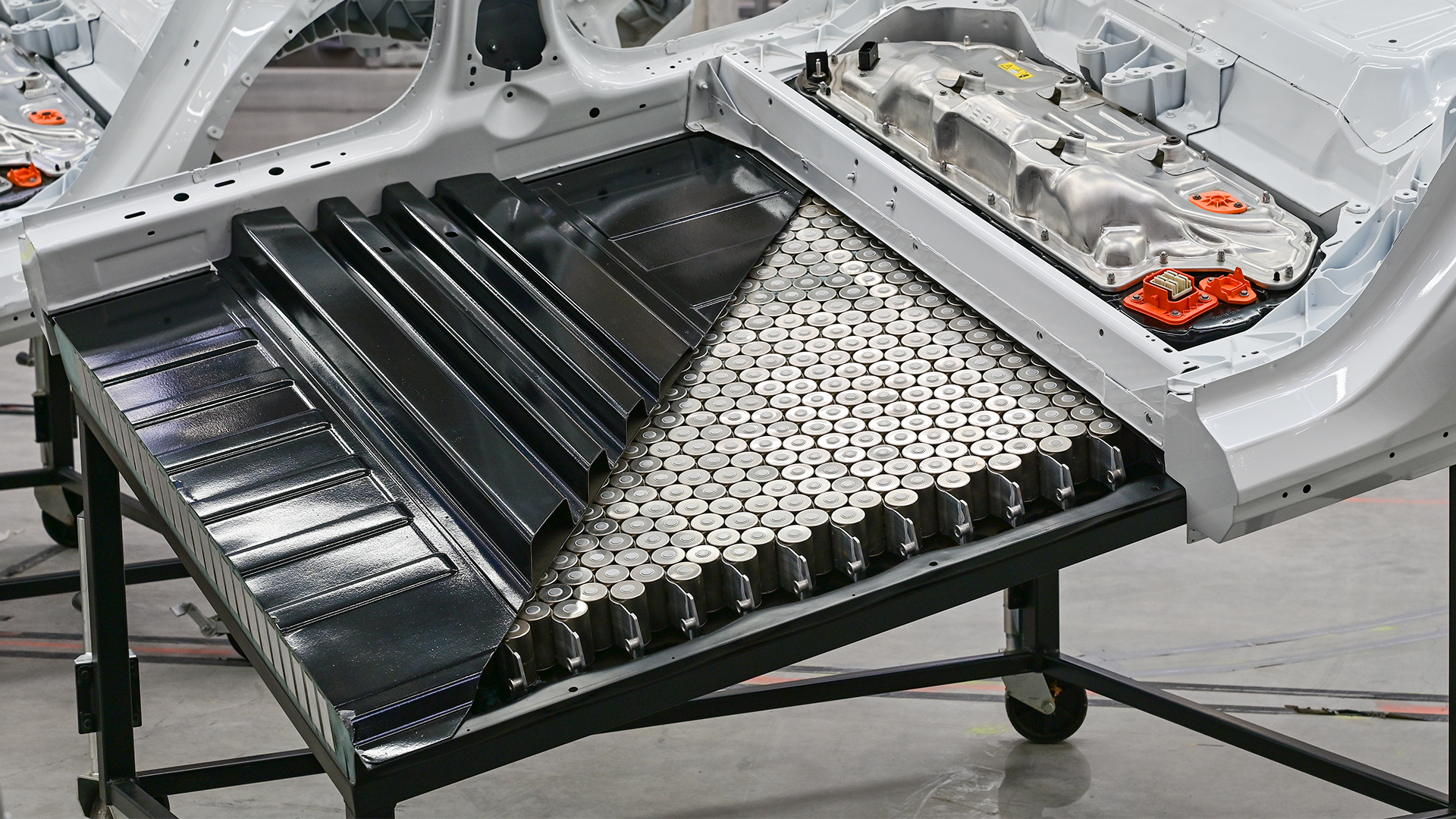

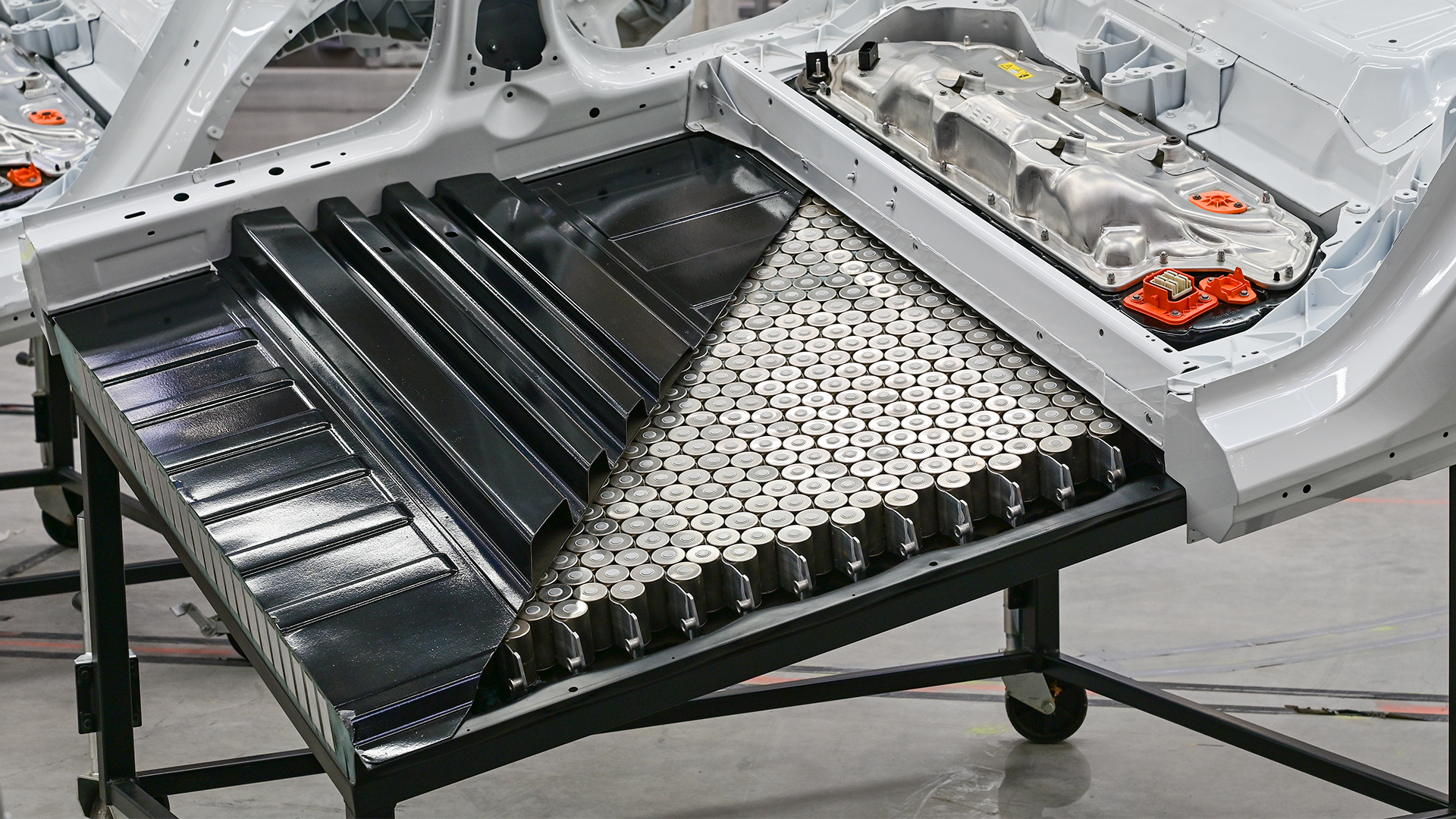

On the U.S. side of the market, Tesla is reportedly having issues scaling production of its new 4680 cells. Tesla first introduced these cells to the public at Battery Day 2020, touting a projected savings of around 50% versus its existing 2170 cells. According to a report from Reuters, the automaker’s breakthrough electrode dry-coating process—which was derived at least in part from its $200 million acquisition of Maxwell Technologies in 2019—is proving to be difficult to perfect. This manufacturing hurdle may also be partly responsible for the delay in production for the Tesla Cybertruck and Semi which were seemingly reliant on the 4680 cells to meet claimed range targets.

Got a tip or question for the author? Contact them directly: rob@thedrive.com