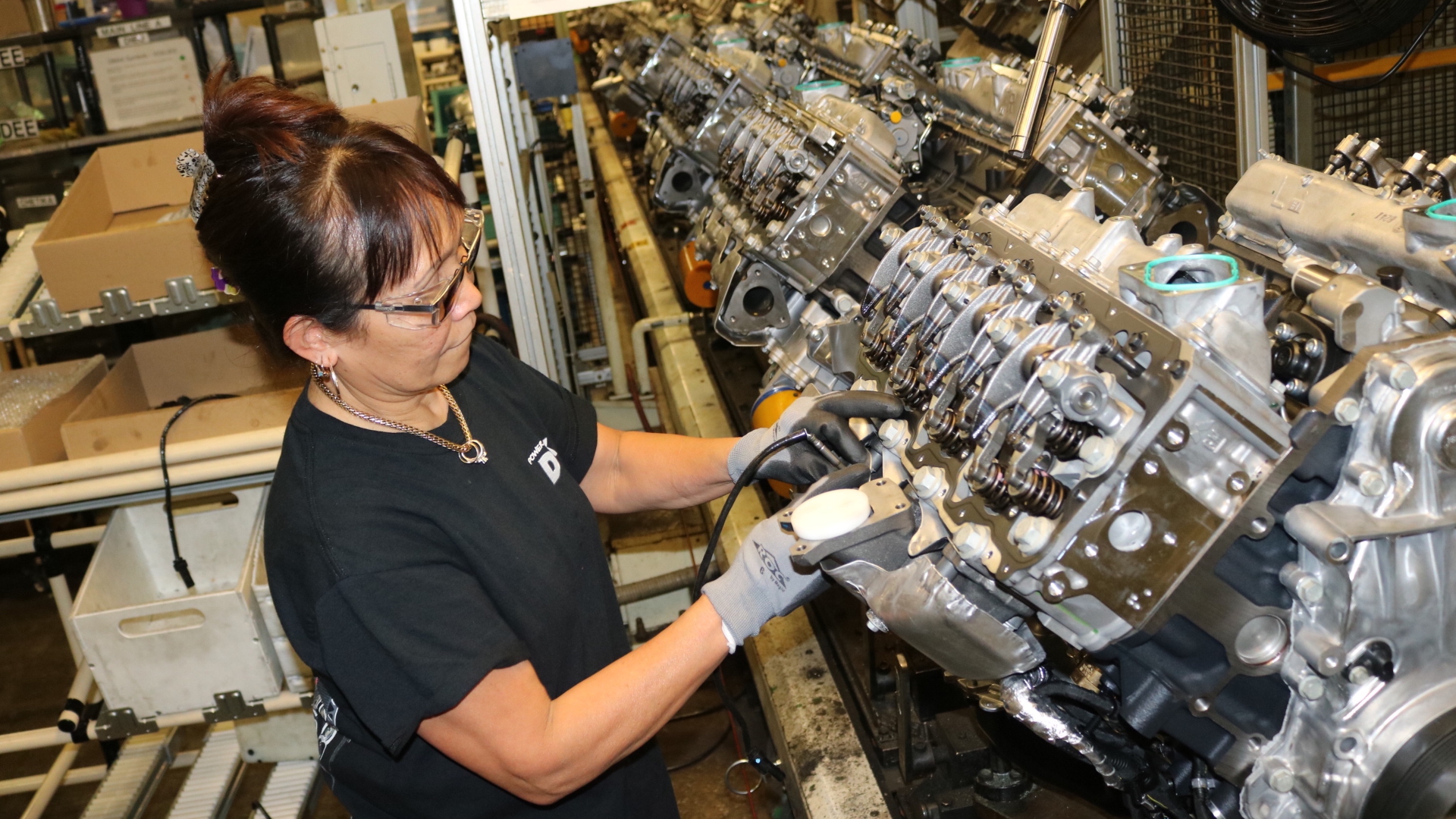

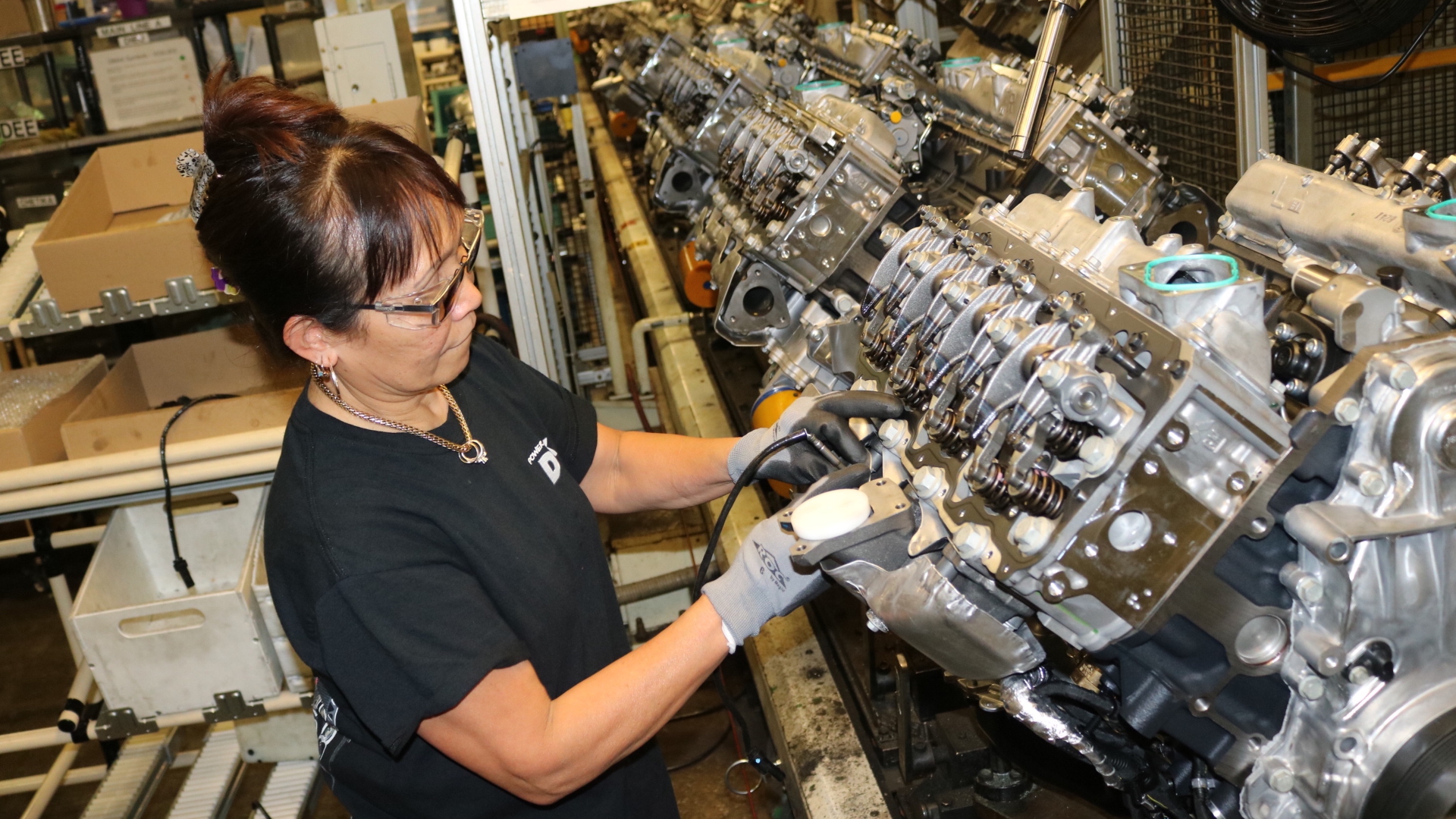

The auto industry’s prioritization of electric vehicles is already coming at the expense of internal combustion engines, even at car companies previously resistant to the shift. Behind the scenes, the implications are being felt in the industry that feeds carmakers—their suppliers—whom consulting firm McKinsey & Company says face a reckoning in the coming years as combustion engines start being phased out. As the auto industry changes, so too must they.

In a report, McKinsey concluded that the market for ICE parts is on the cusp of plunging to effectively a quarter of its volume from the late 2010s. “Engine systems,” which were a $73 billion business in 2019, McKinsey anticipates will decline to just $17 billion by 2035, while transmissions will fall from $93 billion to $25 billion over the same period. The firm advised suppliers of such components to pursue a “simplified yet stable supply base,” and commence “fundamental separation” of operations with potential for failure and growth.

In the former case, McKinsey advised suppliers facing declines to fulfill their existing obligations and cap costs as the ICE parts market shrinks, pursuing acquisitions or mergers where appropriate. In the latter, McKinsey suggested gambling on new sources of income, either outside the automotive field or identifying rising technologies within it.

One such candidate is advanced driver-assistance systems (ADAS), a field of immense promise, but at present, also instability. Uncertainty surrounding how quickly vehicular autonomy will improve, as well as which technologies might prevail, affects how ADAS systems are designed, and thus what sorts of components will be needed.

All in all, McKinsey’s advice for suppliers can be distilled into a few simple words: Change or be changed. In a world where the future becomes increasingly uncertain, it’s a maxim that holds true for far more than cars and their parts.

Got a tip or question for the author? You can reach them here: james@thedrive.com