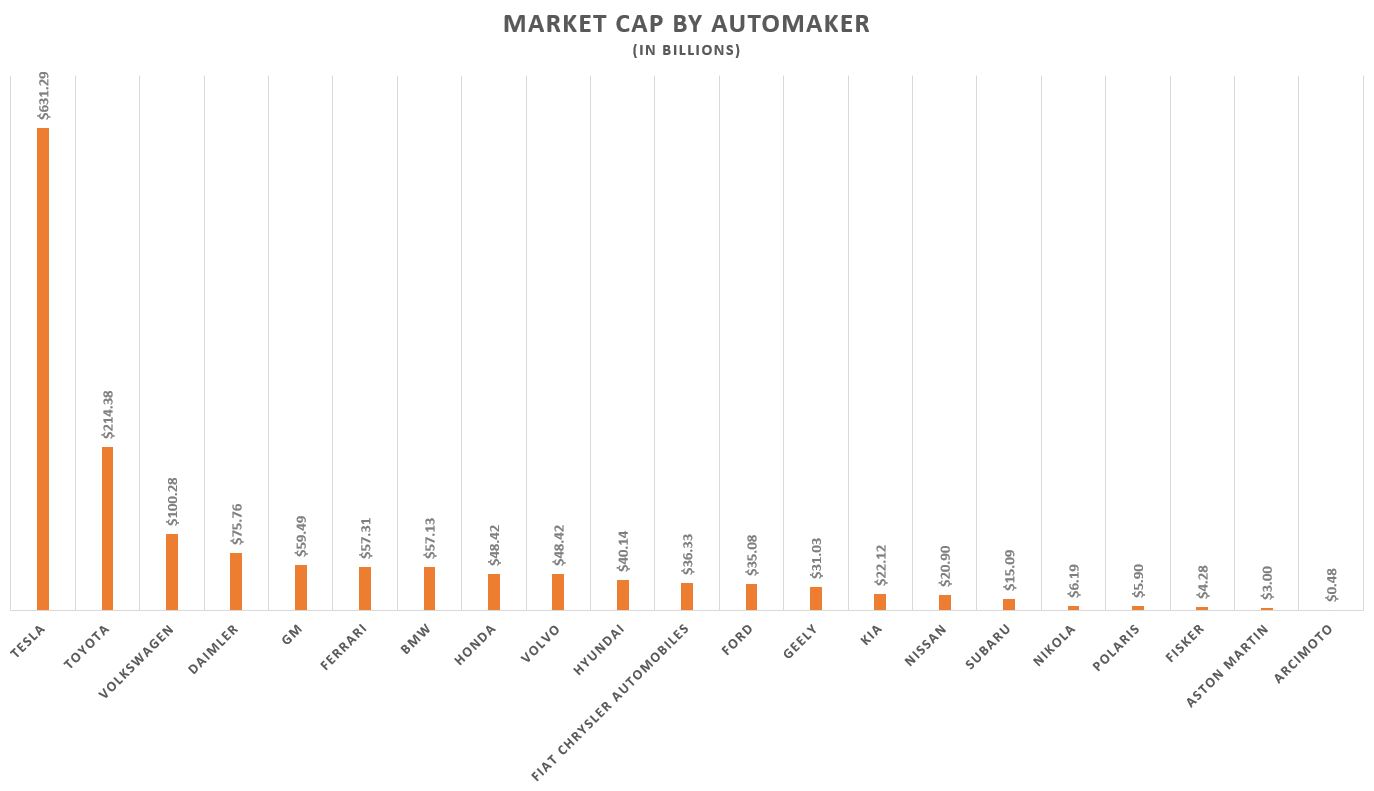

All-electric automaker Tesla has a weird relationship with its stock price. Owners, investors, and even CEO Elon Musk are imbued with how the company’s financials perform, and that has led the California-based company to skyrocket in value despite its relatively moderate-volume output. Now, Tesla has become not only the most valuable car company in the world but also more valuable than the next six automakers combined with a valuation of $631.29 billion at the time of writing.

Worldwide, that means Tesla is more valuable than Toyota, Volkswagen, Daimler, and General Motors, plus China-based BYD and NIO which are also publicly traded on the U.S. stock market. And Tesla’s value becomes even more apparent by looking at automakers who actively conduct consumer-facing business in the U.S., as that trades BYD and NIO for Ferrari, BMW, and Honda.

In part, Tesla’s value comes from its broad coverage of different business segments. For example, in addition to being an automaker, Tesla has its own revenue-generating network of charging stations which could be viewed parallel to owning a chain of gas stations. It also has branched out into the solar and power storage markets, and Musk has previously expressed interest in moving inside the home with HVAC appliances.

But its real claim to fame has been its attempt to revolutionize driving by leading the consumer-attainable automated vehicle segment. Today, Tesla doesn’t sell a self-driving car (nobody does, actually), but it’s trying to get there. The automaker recently released a beta for its “Full Self-Driving” for customers who purchased the $10,000 add-on. But should Tesla succeed, Musk’s promise of robotaxis might be realized.

Still, one must question whether or not Tesla’s ballooning stock is overvalued. Even Musk himself said that the stock price was too high earlier this year (yet it still issued a stock-based capital raise later), and analysts from reputable firms like JPMorgan share similar concerns even today.

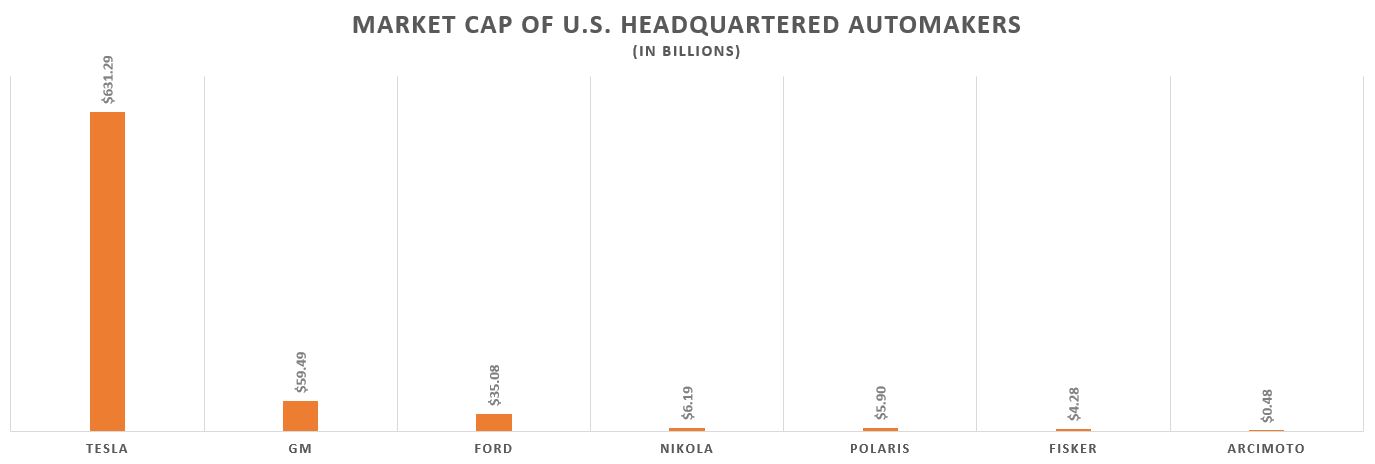

Back in January, Tesla took the crown of “Most Valuable American Automaker” with a market cap of $86.1 billion. Today, it’s grown to more than seven times that and is now worth more than all U.S.-headquartered automakers put together. Technically, Fiat Chrysler is headquartered in the U.K., so it isn’t listed in the chart above. But even if it were, it wouldn’t make much of a difference given its relatively measly $36.3 billion market cap.

Is Tesla stock really worth as much as it currently trades for? Maybe—but also, maybe not. Its volatile nature is one reason the stock attracts so many short-sellers, and it also made the decision to include it in the S&P 500 pretty controversial.

It would appear that EV stocks as a whole are being pushed into a bubble while investors are chasing the next big thing in automotive tech. The chase to replicate Tesla’s success through SPACs is a trick we’ve seen more and more throughout 2020, and it just goes to show that corporations hurrying electric cars see Wall Street push and are using it to their advantage through rapid fundraising.

Got a tip? Send us a note: tips@thedrive.com