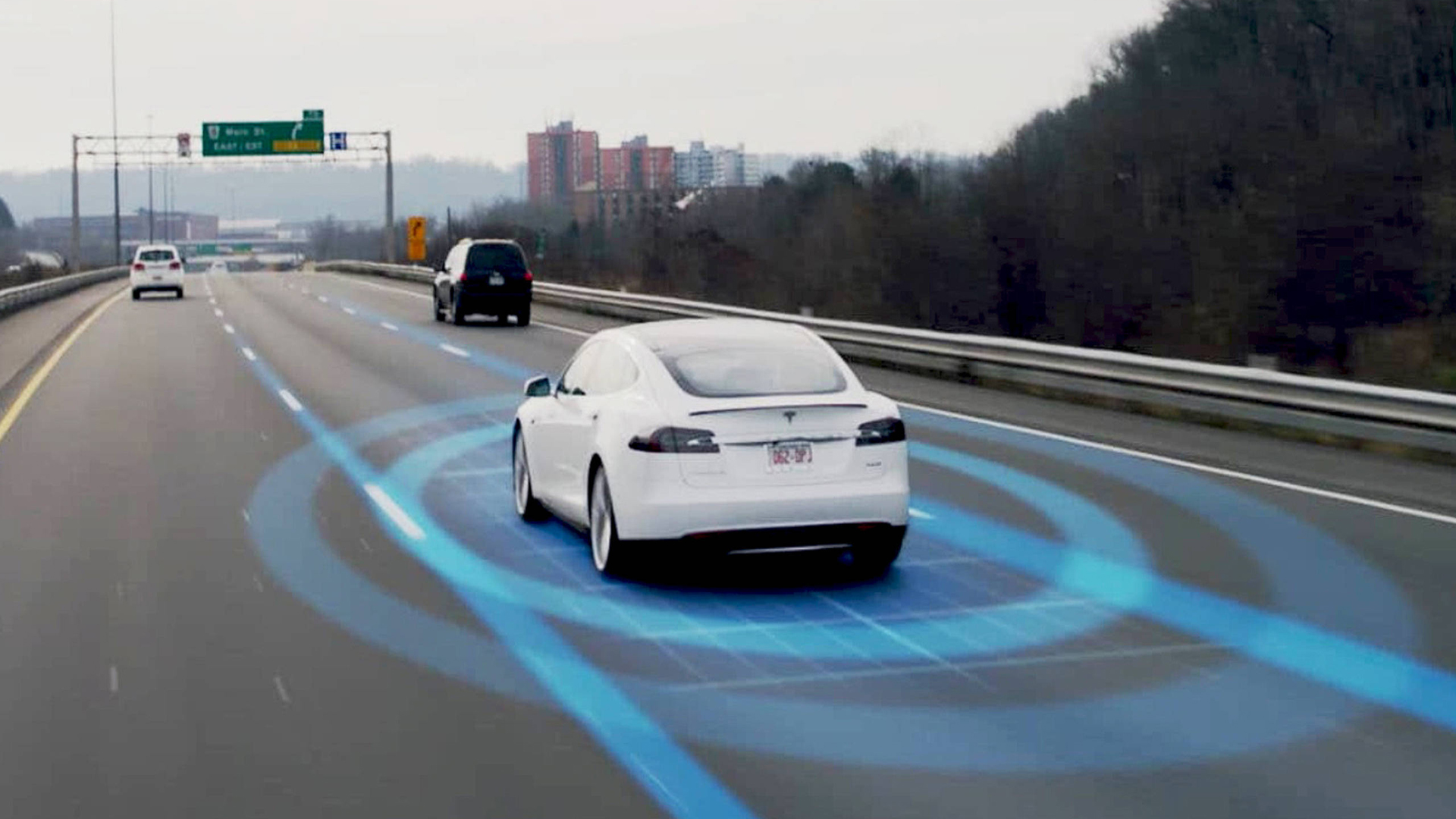

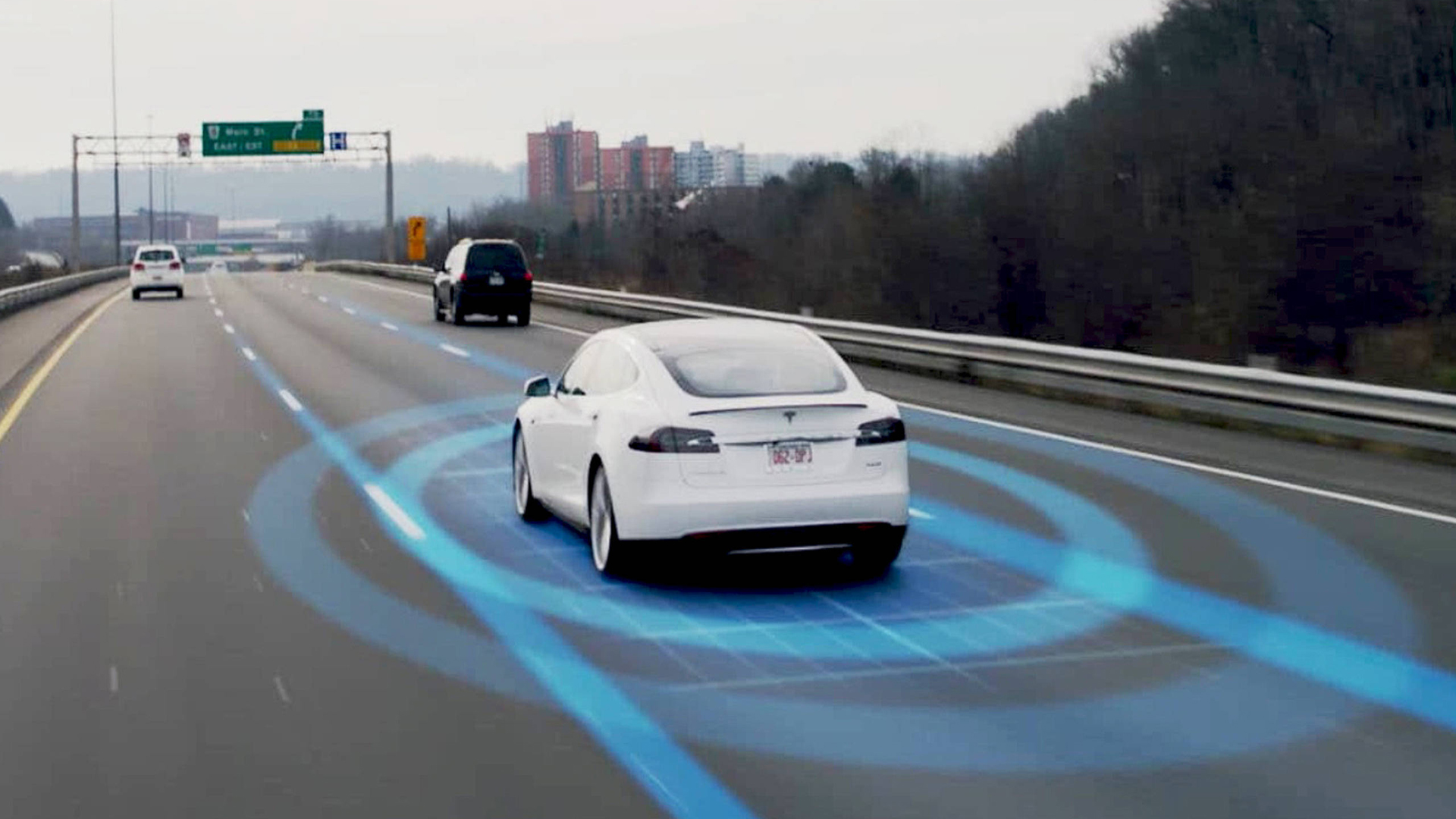

Tesla announced Wednesday it will offer its Full Self-Driving Autopilot upgrade via a premium subscription service by the end of 2020.

The news was first confirmed by the company’s CEO Elon Musk during Tesla’s quarterly earnings call. Currently, there’s no telling what Tesla plans to charge for the FSD subscription service, but it’s not likely to be cheap.

On one hand, the service must be affordable for an owner to justify purchasing it. On the other, Tesla’s Chief Financial Officer Zachary Kirkhorn says that purchasing FSD outright “will be the least expensive plan on a monthly basis to own.” This makes it even more difficult to project a price, especially given Tesla’s methods of listing vehicle costs with various incentives factored in.

Today, Tesla charges $7,000 on top of the vehicle price to upgrade its Autopilot suite with “Full Self-Driving” capabilities. $7,000 spread out over the cost of a 60-month auto loan using the average interest rate of 5.27 percent would equate to roughly $133 per month, which isn’t exactly easy to stomach compared to a streaming service. Remember that Musk has also said that Tesla’s semi-autonomous functionality makes the vehicle an appreciating asset, so it’s not clear if this appreciation is being taken into consideration when determining a price for the FSD subscription.

“[I]t will still make sense to buy FSD as an option as in our view, buying FSD is an investment in the future,” said Musk during the earnings call. “And we are confident that it is an investment that will pay off to the consumer—to the benefit of the consumer. In my opinion, buying FSD option is something people will not regret doing.”

If you haven’t been living under a rock for the past few years, you’ve clearly seen the uptick in subscription services. Sure, you ditched cable TV, but you’ve also bought into Netflix and Hulu. There’s also your Spotify subscription, and that secret loot box you’ve been pulling out of your mailbox every month.

Silicon Valley loves steady revenue streams. If there’s a near-guaranteed way to lock someone into a service, it’s with an affordable subscription, and let’s face it, Tesla’s work-fast-and-break-things mentality is more closely aligned with Facebook than it is with legacy automakers. After the automaker’s $2.3-billion capital raise, it’s clear that Tesla is continuing to find creative ways to increase its earnings.

Got a tip? Send us a note: tips@thedrive.com