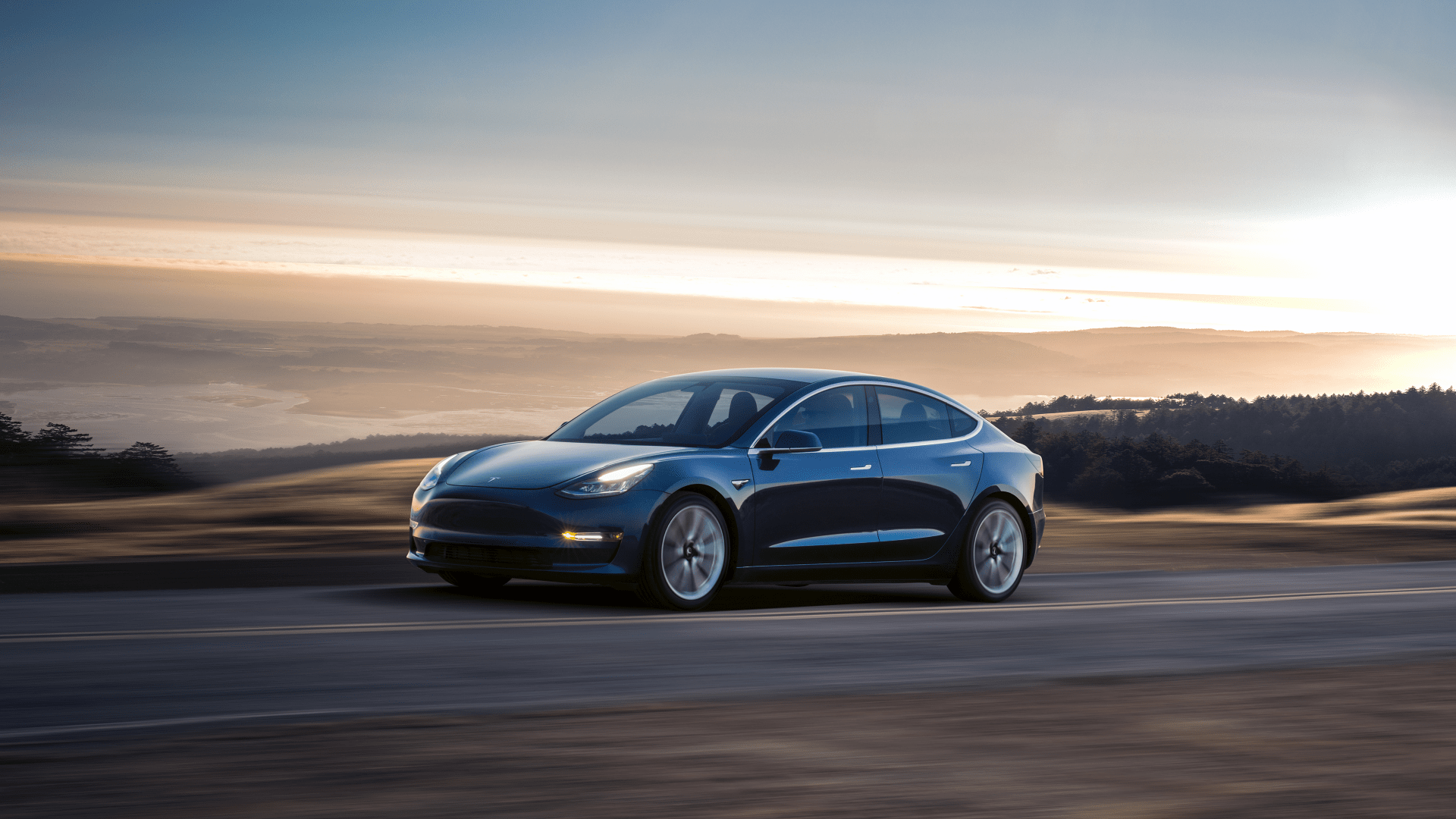

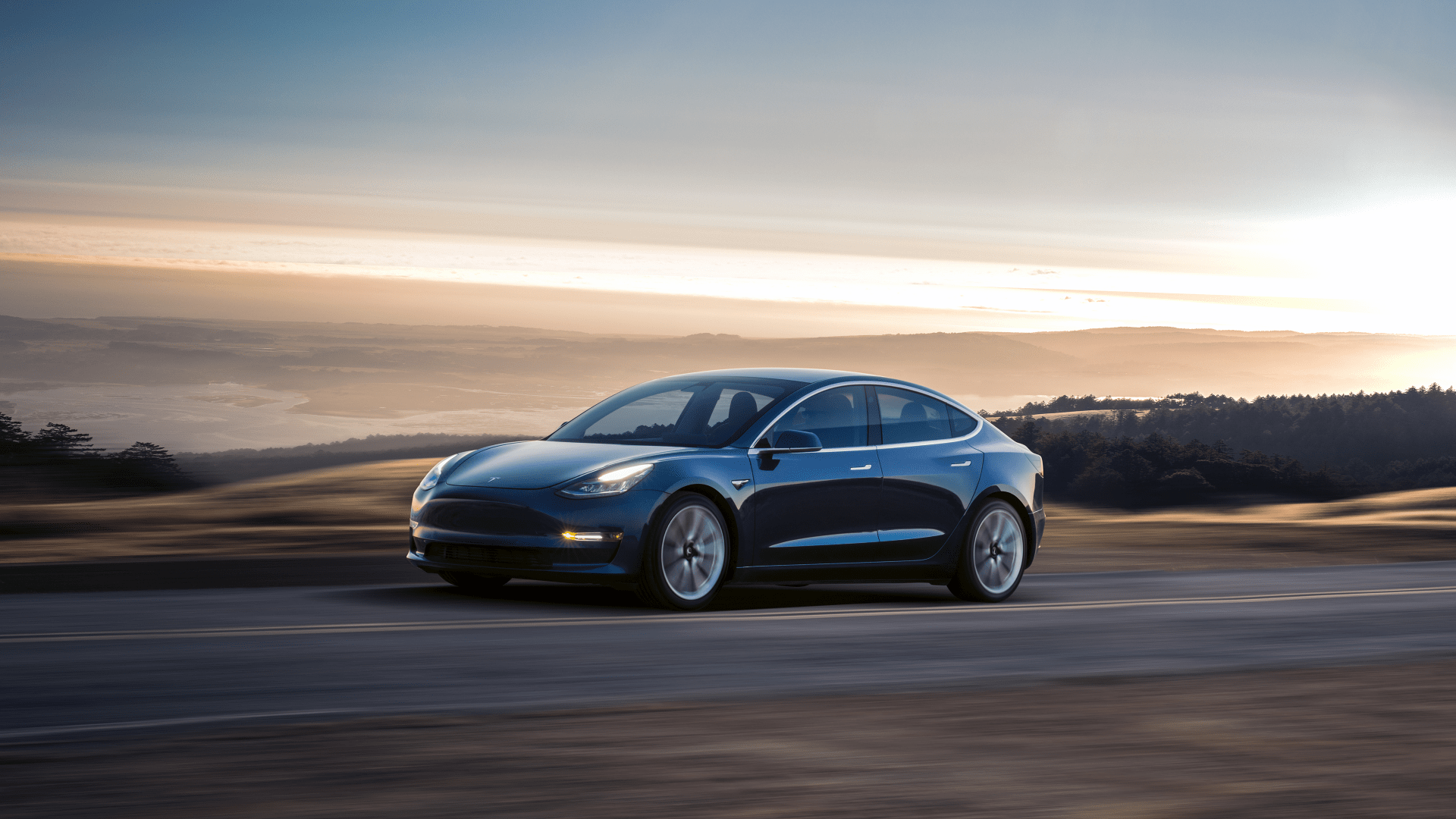

Tesla has reduced pricing on the Model 3, S, and X by $2,000 in light of losing the $7,500 federal tax credit formerly dealt to buyers of the Californian electric vehicles. As of Jan. 1, new Teslas delivered only qualify for half of the original rebate—$3,750—and that number will be slashed again in six months to $1,875 before vanishing completely in 2020.

The United States federal government dropped the $7,500 incentive after Tesla sold its 200,000th vehicle taking advantage of the credit in June. This can be cited as the reasoning for the net price increase across Tesla’s lineup despite the new discount.

The price reduction by Tesla doesn’t fully negate the recent tax credit cut but the Elon Musk-led company hopes it will soften the blow. The final quarter of 2018 saw the highest sales ever for the manufacturer with 90,700 total vehicles delivered as part of a major push before the end of the year. In total, Tesla delivered 63,150 examples of the Model 3, an additional 14,050 Model X SUVs, and finally, 13,500 Model S units during Q4. However, that was still short of Wall Street estimates, causing a nearly 8.7 percent drop in $TSLA stocks.

For any buyers who were scheduled to take delivery before Dec. 31, 2018, but could not due to an issue on Tesla’s end, Elon Musk has promised to have the automaker cover the difference.

Tesla told The Drive in a statement, “Moving beyond the success of Q4, we are taking steps to partially absorb the reduction of the federal EV tax credit (which, as of January 1st, dropped from $7,500 to $3,750). Starting today, we are reducing the price of Model S, Model X, and Model 3 vehicles in the U.S. by $2,000. Customers can apply to receive the $3,750 federal tax credit for new deliveries starting on January 1, 2019, and may also be eligible for several state and local electric vehicle and utility incentives”