Velodyne is slashing the price of what the company describes as its most popular lidar sensor, the VLP-16 Puck, in half. Given that lidar is among the most expensive components of self-driving cars, the price reduction could help facilitate widespread adoption of autonomous vehicles.

When it first went on sale in 2016, the VLP-16 Puck retailed for around $8,000, so customers will now pay about $4,000 for one. A single VLP-16 can scan 360 degrees around a vehicle, at a range of up to 100 meters (328 feet). Even before the price cut, the VLP-16 was positioned as a more cost-effective alternative to Velodyne’s higher-performance VLP-32 Ultra Puck, HDL-32 and HDL-64, both of which offer more capability. The HDL-64, for example, emits four times the number of lasers as the VLP-16.

Velodyne says it was able to lower the VLP-16’s price because of its new “megafactory” in San Jose, California. The factory, which opened in 2017, helped streamline the manufacturing process, Velodyne said in a press release.

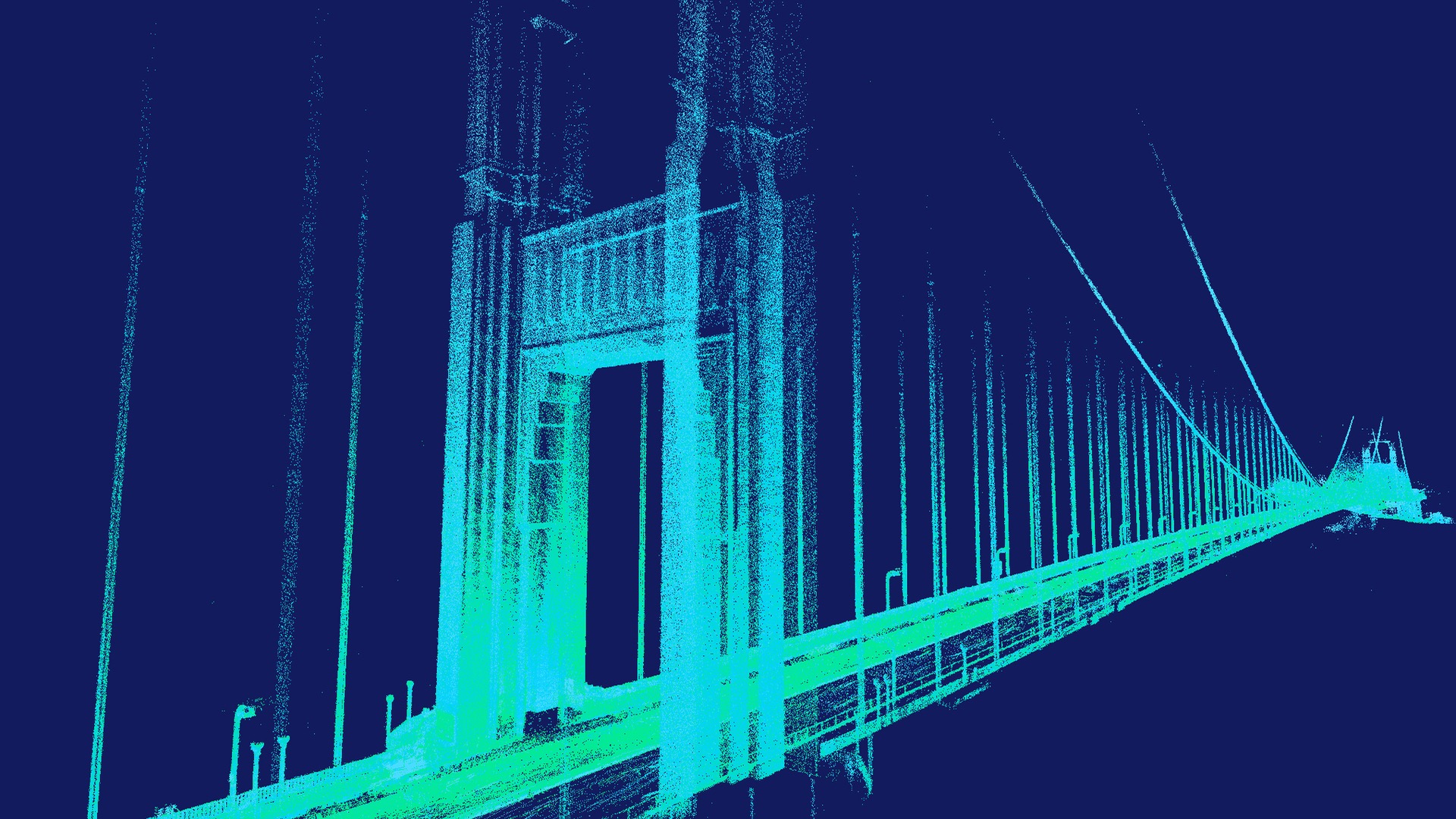

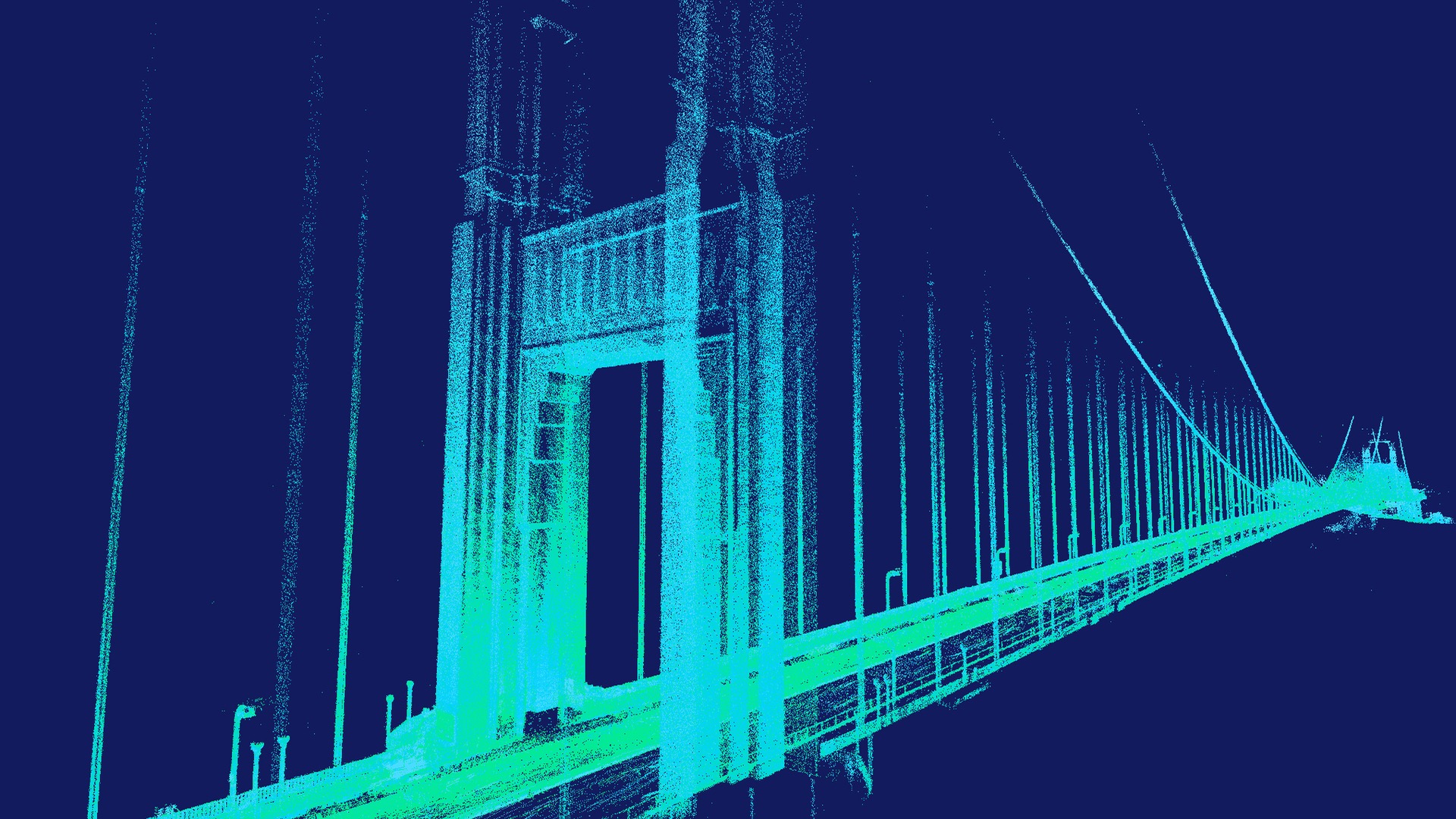

Along with cameras and radar, lidar, (which works like radar but uses light instead of radio waves), is part of the holy trinity of sensors that allow most self-driving cars to function. Of the three sensors, lidar has been subject to the most intense development efforts as companies look to integrate with future production self-driving cars. Several startups have emerged to challenge Velodyne’s leadership, and Waymo and Uber are developing their own systems in-house. Those efforts are now wrapped up in the court case between the two companies.

For self-driving cars to be affordable, lidar will have to be affordable. Velodyne has taken an important step toward that goal, but there is still a long way to go. The VLP-16 is the company’s entry-level sensor, and production self-driving cars may require more elaborate hardware to function as intended. Despite its big new factory, Velodyne is still supplying units primarily to small-scale development efforts. If automakers start rolling self-driving cars off their assembly lines at scale, will Velodyne be able to keep up?